Priya had been waiting for her international payment to go through. She sent money to her brother studying abroad, but it took 4 days to reach him. The delay? Multiple banks, checks, and middlemen along the way. Now imagine if that payment could happen in 5 seconds — safely, transparently, and without extra charges.

That’s where Blockchain steps in.

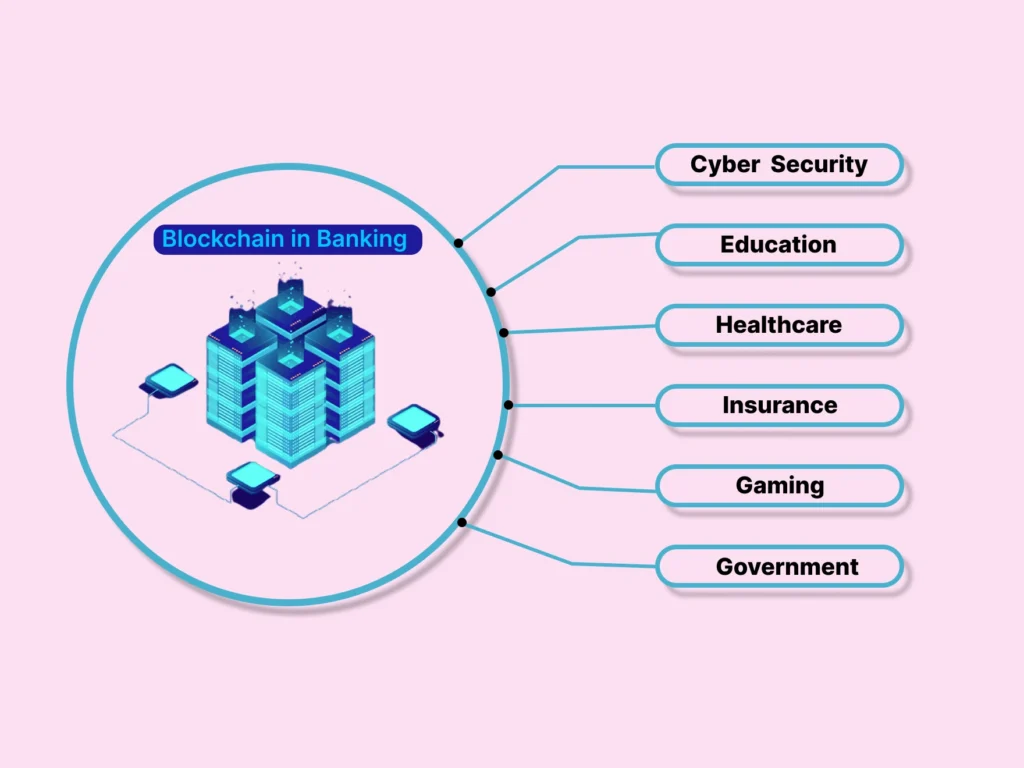

It’s not just about Bitcoin or crypto anymore. Banks are now using blockchain to speed things up, cut costs, and improve trust. Let’s break it down.

What is Blockchain?

Think of blockchain as a digital ledger like a notebook — but online. Every time something happens (like a payment or a loan), a record is written in that notebook.

Now, imagine that a notebook is shared across thousands of computers — and once something is written in it, no one can erase or change it. Everyone sees the same version. That’s blockchain.

This makes transactions secure, transparent, and nearly impossible to tamper with — which is why banks are excited about it.

Why Banks Are Using Blockchain

Banks deal with one thing more than anything else: trust. They handle money, records, loans, and identities. But current systems can be slow, expensive, and easy to hack.

Blockchain offers:

- Faster transactions

- Lower processing costs

- Stronger security

- No need for middlemen

1. Cross-Border Payments

Traditional international money transfers go through a long chain:

->your bank → central bank → international network → receiver’s bank. This takes days and involves extra fees.

->With blockchain, the transfer is direct and instant. No middlemen. No delays.

->Some banks use Ripple, a blockchain network, to move money across borders in seconds.

Real Example: Santander Bank and Axis Bank have used Ripple Net to make international transfers smooth and fast.

2. Smart Contracts for Loans

A smart contract is a digital agreement written on blockchain. It gets triggered automatically when certain conditions are met — no human needed. In banking, this can be used for:

- Auto-loans

- Home loans

- Business credit

Example: If a person pays EMI on time for 6 months, the system could automatically reduce their interest rate — no paperwork, no approval process. It saves time and avoids fraud.

3. KYC and Identity Verification

->Banks spend a lot of time and money verifying who you are (KYC – Know Your Customer).

->What if once your identity is verified by one bank, other banks could access it securely without repeating the whole process?

->Blockchain can create a shared KYC system. You’re verified once, and that data is stored in a secure, unchangeable way.

Real Example: SBI (State Bank of India) is exploring blockchain-based KYC solutions with startups to improve efficiency.

4. Trade Finance

When companies import or export goods, banks are involved in handling documents like invoices, shipping records, and payments. Right now, most of this is still done on paper or email — which slows everything down.

Blockchain helps create a digital version of this process where every party can see and verify documents in real-time.

This means:

- Fewer errors

- Less fraud

- Faster transactions

Real Example: HSBC used blockchain to complete a trade finance deal in just 24 hours — which usually takes 5–10 days.

5. Fraud Prevention and Security

Every year, banks lose billions due to fake transactions, identity theft, or tampered data.

Since blockchain records can’t be changed and every transaction is timestamped and verified, it’s much harder for fraud to go unnoticed.

Even if one system is hacked, the network stays safe because it’s decentralized.

Challenges Still Exist

Of course, blockchain in banking isn’t perfect yet.

- It needs global rules and standards.

- Banks have to work together.

- The tech is still evolving.

But slowly and surely, we’re seeing real change — not just in big banks but even in everyday services.

What This Means for Students

If you’re in school or college right now, this shift is good news. Banking is going digital. And it needs people who understand both finance and tech.

Here are career paths growing fast:

- Blockchain Developer

- FinTech Analyst

- Smart Contract Engineer

- Risk & Compliance Tech Expert

- Digital Payments Specialist

If you’re from a commerce, science, or management background and love tech, there’s space for you here.

The Way Forward

At FACE Prep Campus, we offer industry-ready degree programs like:

- BCom FinTech with AI

- BBA in FinTech and Banking

- BCom Specialization in FinTech and Blockchain

- BCom with Digital Marketing & E-commerce

These courses teach you the latest in AI, blockchain, digital banking, and more — all while giving you hands-on projects and 100% placement support.