Just a few years ago, Arjun had to walk into a bank to open a savings account. He filled out long forms, waited in a queue, and had to visit again just to update a small detail. Fast forward to today — his younger sister opened a digital account in five minutes through an app. No paperwork. No queues. Just a few taps.

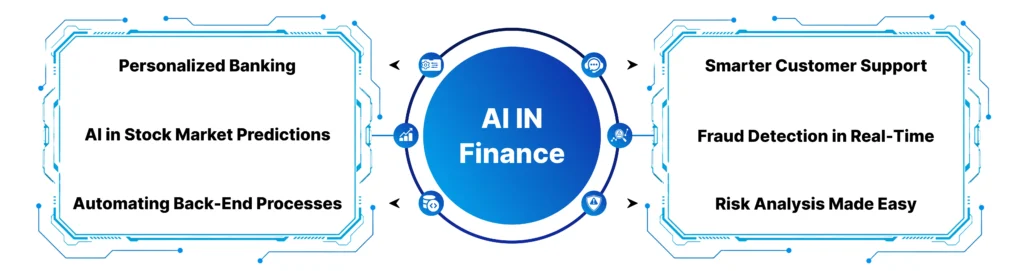

AI is no longer something we see only in sci-fi movies. It’s shaping real-world industries — and finance is one of the biggest ones. Let’s explore how AI and ML are transforming the way banking and finance work.

What Is AI in Finance?

AI in finance using smart computer systems that learn from data to make decisions — just like humans, but faster and more accurately.

Machine Learning is a part of AI. It helps banks spot patterns, predict risks, detect fraud, and offer better services without needing someone to code every possible scenario.

Banks deal with tons of data every day — customer details, transactions, loans, credit scores. Machine learning helps them understand and act on this data smarter and quicker.

1. Smarter Customer Support

Remember the long hold time when calling customer care? Not anymore.

Now, AI chatbots can answer most banking questions — balance checks, recent transactions, credit card issues in seconds. These bots don’t sleep, don’t take breaks, and are getting better at talking just like humans. Some even use Natural Language Processing (NLP), which helps them understand and respond in a more conversational way.

2. Fraud Detection in Real-Time

Ever got a message from your bank asking, “Did you just try to pay ₹20,000 in another city?” That’s AI at work.

Banks train machine learning models to learn your spending patterns. If something looks off — like a sudden big payment in a place you’ve never been — the system flags it. This real-time fraud detection is helping banks save millions and protect customers.

Without AI, these checks would take hours or even days — by which time the damage is done.

3. Risk Analysis Made Easy

When someone applies for a loan or credit card, the bank has to decide if that person can repay it. Earlier, this decision was based mostly on credit scores and paperwork. Now, banks use AI-based risk models.

These models look at:

- Transaction history

- Spending habits

- Employment data

- Social behavior (like digital footprints)

They can assess risk better and faster than traditional methods — helping banks avoid bad loans and giving genuine customers quicker approvals.

4. Personalized Banking

Not everyone wants the same financial advice. A student and a small business owner have different needs. AI helps banks offer personalized financial advice. Based on your past behavior, spending, and goals, it can suggest:

- Budget plans

- Investment tips

- Credit card offers

- Loan options

This level of customization makes users feel like the bank “understands” them — all thanks to data and machine learning.

5. AI in Stock Market Predictions

Big financial firms and traders now use machine learning algorithms to predict stock prices, market trends, and even global economic shifts.

While these systems don’t guarantee profits, they help make smarter trading decisions by spotting patterns that humans might miss. Some platforms now use AI to recommend mutual funds or portfolios based on your risk level and income.

This is making investing more accessible, even for first-timers.

6. Automating Back-End Processes

Behind every bank app or branch, there’s a ton of manual work — verifying documents, updating details, processing transactions.

AI automates many of these tasks using RPA (Robotic Process Automation). It’s like having a digital assistant that handles repetitive jobs without errors.

This means fewer delays, faster services, and less human workload.

The Future of Banking Is AI-Driven

From customer service to cybersecurity, AI is reshaping every corner of banking. And we’re just getting started. In the future, you might have:

- Voice-based banking assistants (like Siri for your bank)

- Fully automated loan approvals

- AI-managed investment portfolios

- Hyper-personalized banking apps

Banks that adopt AI are growing faster and offering better experiences. Those who don’t may fall behind.

What Does This Mean for Students?

If you’re a student thinking about your future, this shift towards AI in finance opens up exciting career paths. You no longer need to pick just one — “tech” or “finance.” Now, you can do both.

Careers are booming in:

- Financial Data Analysis

- FinTech Development

- AI-Driven Risk Management

- Fraud Analytics

- Personal Finance Tools

If you know Python, ML, and how finance works — you’re already in demand.

Want to Get Ahead in FinTech?

At FACE Prep Campus, we offer career-ready programs like:

- BCom FinTech with AI

- BBA in FinTech and Banking

- BCom with Digital Marketing & E-commerce

With a mix of theory and hands-on projects, you’ll build skills in AI, machine learning, finance tools, and get trained by industry mentors. Plus, 100% placement support. So whether you’re from science, commerce, or management, this is your launchpad into the future of FinTech